Global financial markets are closely watching the latest International Gold Price Forecast after analysts at JPMorgan Chase & Co. projected that gold prices could reach $6,300 per ounce by the end of the year.

The prediction, released in a recent market outlook, reflects rising geopolitical tensions, persistent inflation pressures, and increased demand for safe-haven assets worldwide.

Experts say the surge could reshape investment strategies across global markets, including Asia, Europe, and emerging economies, as investors increasingly turn to gold to protect their wealth amid economic uncertainty.

Gold Prices Could Reach Historic Highs

Gold has long been considered a safe investment during economic turmoil. However, the latest forecast suggests an unprecedented surge that could push prices to record levels.

According to market analysts, the projection is based on multiple factors:

- Ongoing global economic instability

- Rising inflation across major economies

- Central bank gold purchases

- Weakening currency values

- Geopolitical conflicts affecting financial markets

If realized, the projected price of $6,300 per ounce would represent a major leap from current trading levels and could significantly impact global financial systems.

Financial experts believe that such a rise would not only influence investors but also affect industries such as jewelry manufacturing, technology production, and central banking policies worldwide.

Key Drivers Behind the International Gold Price Forecast

Inflation and Currency Devaluation

One of the primary reasons behind the strong International Gold Price Forecast is persistent inflation in major economies. Rising consumer prices reduce the purchasing power of currencies, encouraging investors to move their funds into tangible assets like gold.

Gold traditionally performs well during periods of high inflation because it retains value when paper currencies weaken. Analysts expect continued inflationary pressure to support higher gold demand throughout the year.

Geopolitical Tensions and Economic Uncertainty

Global political instability also plays a major role in boosting gold prices. Conflicts, trade disputes, and regional tensions create uncertainty in financial markets, pushing investors toward safer assets.

Recent global developments have increased market volatility, prompting many investors to diversify their portfolios with precious metals. Analysts suggest that continued geopolitical risks could further strengthen gold’s position as a reliable store of value.

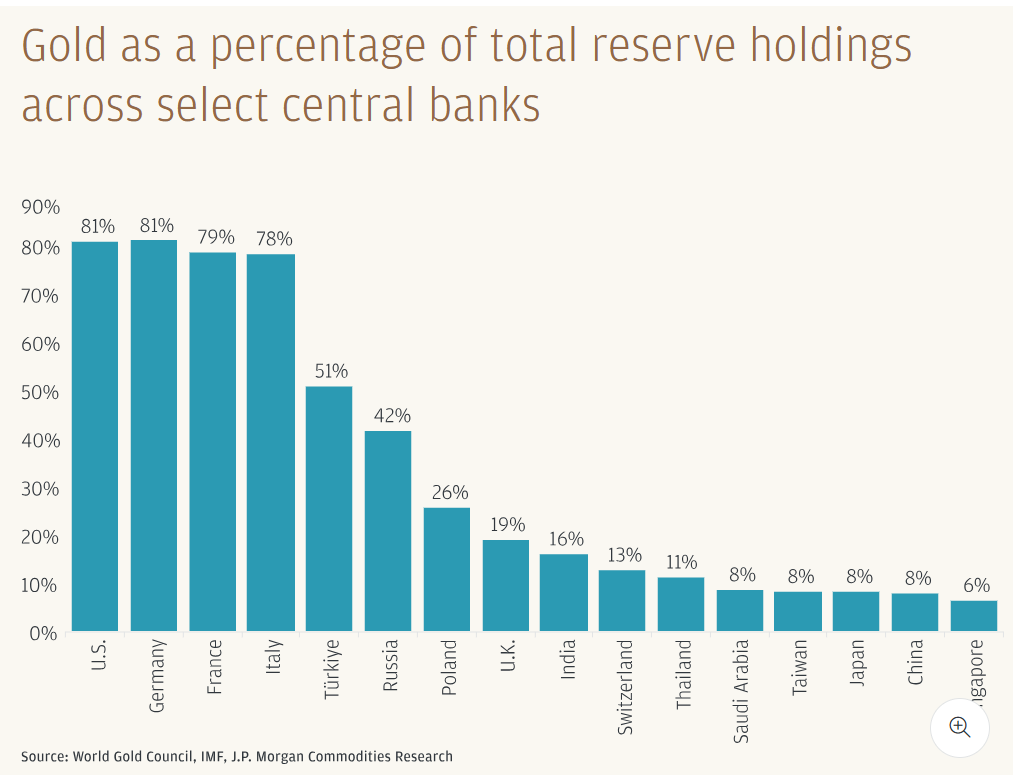

Central Bank Demand

Central banks around the world have significantly increased gold purchases in recent years. These purchases are part of efforts to diversify reserves and reduce reliance on foreign currencies.

Strong central bank demand limits gold supply in the market while increasing overall demand — a combination that typically drives prices higher.

Interest Rate Trends

Interest rates also influence gold prices. When interest rates decline or remain low, the opportunity cost of holding gold decreases, making it more attractive to investors.

Market expectations of potential rate adjustments in major economies have further strengthened the bullish outlook for gold.

Global Market Impact of Rising Gold Prices

A sharp rise in gold prices could have widespread consequences across multiple sectors.

Investment Markets

Investors may shift funds from equities and bonds into gold-backed assets. Exchange-traded funds (ETFs), bullion investments, and gold mining stocks could experience increased demand.

Financial advisors often recommend portfolio diversification, and rising gold prices could accelerate this trend.

Jewelry and Consumer Markets

Higher gold prices typically increase costs for jewelry manufacturers and retailers. Consumers may face higher prices for gold-based products, potentially reducing demand in some markets.

However, strong cultural demand for gold in countries like India and China may continue to support market activity.

Technology and Industrial Use

Gold plays a crucial role in electronics and advanced technology manufacturing. Rising prices could increase production costs for industries that rely on gold components.

Manufacturers may explore alternative materials or adjust pricing strategies if gold prices surge significantly.

Market Experts’ Views on Gold’s Future

Financial analysts remain divided on the exact timeline for gold’s projected surge, but many agree on its long-term upward trajectory.

Some experts believe the $6,300 projection represents a bullish scenario based on worst-case global economic conditions. Others argue that sustained inflation and geopolitical risks make the forecast plausible.

Market observers highlight several indicators to watch:

- Inflation trends in major economies

- Central bank purchasing activity

- Global interest rate policies

- Currency fluctuations

- Political and economic stability worldwide

These factors will likely determine whether gold reaches the projected level within the expected timeframe.

Impact on Emerging Economies

The International Gold Price Forecast holds particular significance for emerging economies where gold plays a major role in financial stability and cultural practices.

Currency Protection

Countries experiencing currency depreciation often rely on gold reserves to stabilize their financial systems. Rising gold prices may strengthen national reserves and improve economic resilience.

Trade and Imports

Higher gold prices could increase import costs for nations that rely heavily on gold purchases. This may affect trade balances and foreign exchange reserves.

Public Investment Trends

In many developing countries, individuals invest in gold as a savings mechanism. A price surge could boost household wealth for existing investors while making new investments more expensive.

Safe-Haven Demand Continues to Grow

Gold’s reputation as a safe-haven asset continues to attract global investors during uncertain economic periods.

During times of market volatility, investors often shift from riskier assets such as stocks to more stable options like gold. This behavior increases demand and supports price growth.

Recent economic disruptions, supply chain challenges, and geopolitical tensions have reinforced gold’s appeal as a secure investment option.

Historical Performance and Future Outlook

Historically, gold prices have surged during major global crises, including financial recessions and periods of high inflation. This pattern strengthens the argument for continued price growth.

Over the past decades, gold has demonstrated resilience as a long-term investment. Analysts suggest that structural economic challenges, including debt levels and monetary policy shifts, could support sustained demand for gold.

However, market experts also caution that price volatility remains possible due to changing economic conditions and investor sentiment.

Risks and Challenges to the Forecast

Despite the strong bullish outlook, several factors could limit gold’s price growth.

- Strong economic recovery in major markets

- Rising interest rates reducing gold’s appeal

- Declining inflation pressures

- Strengthening global currencies

- Reduced geopolitical tensions

These factors could weaken demand for gold and slow its upward momentum.

Investors are therefore advised to monitor market developments closely before making major investment decisions.

Investment Considerations for Investors

Financial advisors recommend careful planning when investing in gold, particularly during periods of price volatility.

Key considerations include:

- Portfolio diversification strategies

- Long-term investment goals

- Market risk tolerance

- Global economic trends

- Currency performance

Investors should also consult financial professionals before making significant investment decisions.

Global Outlook for Gold Prices

The latest International Gold Price Forecast projecting gold at $6,300 per ounce highlights growing concerns about global economic stability, inflation, and geopolitical uncertainty. While the prediction represents a highly optimistic scenario, it underscores gold’s enduring role as a safe-haven asset in uncertain times.

Market trends, central bank policies, and global economic developments will ultimately determine whether gold reaches the projected level. For investors and policymakers alike, the forecast signals the importance of monitoring financial risks and adapting strategies accordingly.

As global markets evolve, gold’s performance will remain a key indicator of economic confidence and financial security worldwide. Investors and analysts will continue watching closely to see whether this bold projection becomes reality.