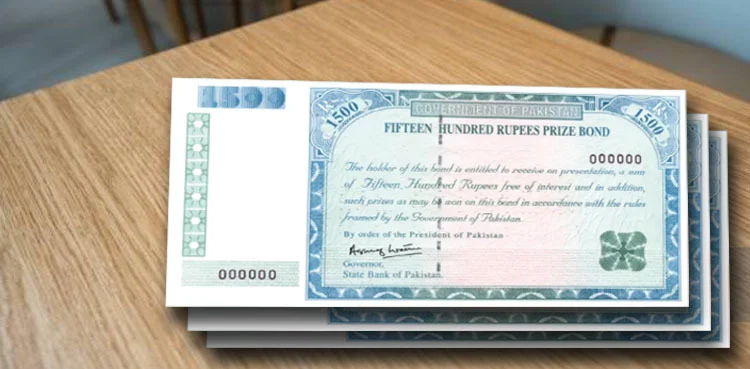

All the customers having submitted the Zakat exemption certificates will be exempted from Zakat deductions.

Govt Announces Zakat Nisab for 2025. In a recent development, the Administrator General Zakat has fixed the Nisab for Zakat for the year 1445-46 AH for Pakistan at the current value of Rs 179,689.

This means that no Zakat deduction will be made from accounts with a balance below this threshold on the first day of Ramzan-ul-Mubarak, 1446 AH, which is expected to fall on March 1 or 2, 2025.

Zakat is deducted from savings bank accounts, profit-and-loss sharing accounts, and all other similar accounts, on amounts beginning from Rs 179,689 and above. All Zakat Collection and Controlling Agencies (ZCCAs) are directed to deduct Zakat at their respective amounts and deposit it in the Central Zakat Account No. CZ-08 at the State Bank of Pakistan.

All the customers having submitted the Zakat exemption certificates will be exempted from Zakat deductions. The Nisab amount has increased from last year’s value of Rs 135,179, thus increasing the Zakat threshold.

The announcement has been made as per the Zakat and Ushr Ordinance, 1980 for the effective collection and distribution of Zakat to serve the underbelly.