A new banking change has shocked customers across Pakistan. ATM withdrawal charges in Pakistan have seen a steep rise. Many banks are now charging up to Rs. 75 per transaction when customers use ATMs of other banks.

Earlier, the ATM withdrawal charges in Pakistan were capped at Rs. 23.44 including tax, a rate that had remained stable for years. Now, with some banks charging as much as Rs. 75 per transaction, many users are left surprised and frustrated.

The sudden increase in fees, introduced quietly without a public announcement, has added to growing concerns over the rising cost of basic banking services.

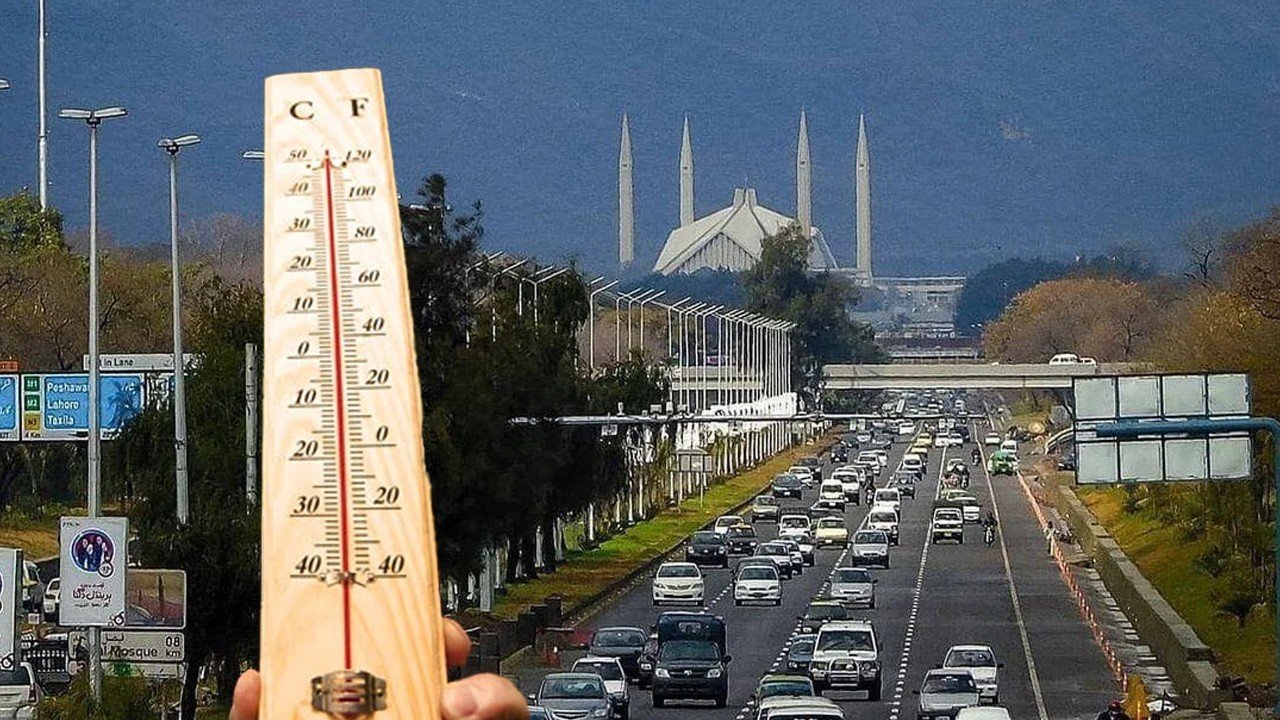

This move is especially hard on those in small towns. Not everyone has access to their own bank’s ATM nearby. Many are now paying extra just to access their own money.

The public response has been loud and clear. Social media is full of complaints. Hashtags like #ATMFeeHike and #BankCharges are trending. People are calling on the State Bank of Pakistan (SBP) to act fast.

“I withdrew Rs. 1,000 and lost Rs. 70 just for using a different ATM. This is unfair,” said one angry user on X (formerly Twitter).

Inflation is already hurting people. This new fee feels like another blow. Daily wage earners, students, and pensioners are among the most affected.

Bank officials say the ATM fee hike is due to rising costs. They point to maintenance, upgrades, and security as reasons. “This is necessary to keep ATM networks running,” a banking source told FactFile.

Still, experts believe this burden shouldn’t fall on customers alone. Many want the State Bank to step in and standardize ATM charges.

So far, the State Bank of Pakistan has stayed silent. But pressure is building. Customers, economists, and consumer groups are all watching closely.

What You Can Do

- Try to withdraw cash from your own bank’s ATM.

- Consider using digital wallets or mobile banking apps to avoid physical withdrawals.

- Keep an eye on your SMS alerts after each withdrawal to track hidden fees.

Stay tuned to FactFile as we continue to monitor this issue and share official updates from SBP and banking authorities.