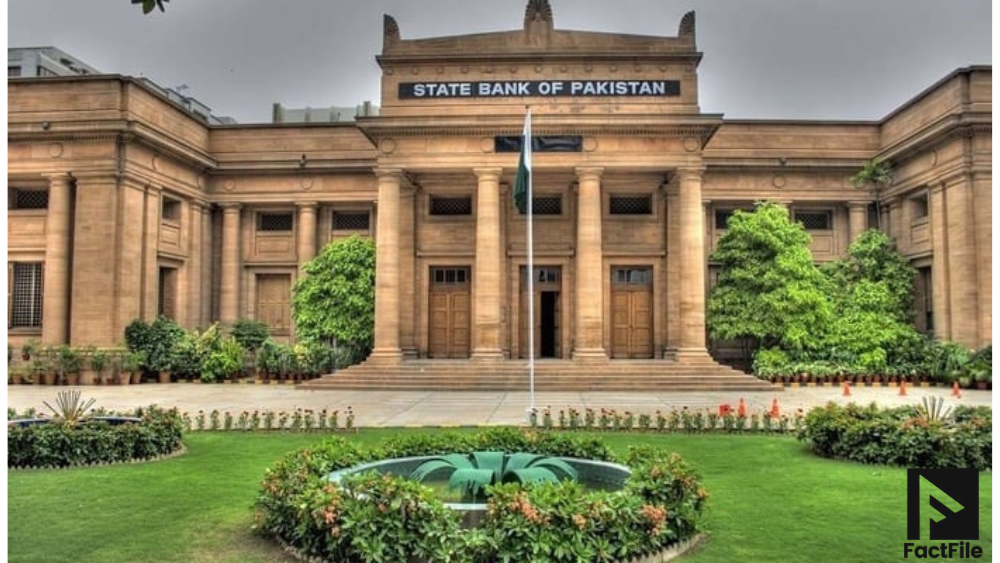

The Ministry of Finance, Government of Pakistan, has confirmed that the Govt Pays Back Loan of Rs. 500 billion to the State Bank of Pakistan (SBP). This major repayment was made four years before the loan’s scheduled maturity in 2029.

Advisor to the Finance Minister, Khurram Schehzad, shared the update on X (formerly Twitter). He said the Debt Management Office (DMO) carried out this early payment. He called it a big step in Pakistan’s debt management strategy.

This repayment reduces reliance on central bank borrowing. It also converts short-term debt into longer-term debt. That lowers risk and future repayment pressure. It strengthens Pakistan’s economy and shows financial discipline.

Government officials say this step shows a strong commitment to forward-looking fiscal planning. The Rs. 500 billion repayment follows last year’s milestone. By December 2024, the government had already bought back Rs. 1 trillion in market debt.

Together, these moves add up to Rs. 1.5 trillion in early debt payments in FY25. This is the first time Pakistan has retired so much debt ahead of schedule. It sends a strong signal of economic confidence and reform.

These actions have helped lower the debt-to-GDP ratio from 75% in FY23 to about 69% in FY25. They have also extended the average maturity of public debt from 2.7 years to 3.75 years. This lowers refinancing risks and creates more room for development spending.

Thanks to falling interest rates, disciplined borrowing, and smart refinancing, the government expects to save Rs. 830 billion in interest payments this year alone.

Analysts say this is not just debt reduction. It shows Pakistan is serious about future-focused financial management. The aim is to build a stronger, more sustainable economy.

Stay connected with Factfile for the latest verified updates on Pakistan’s economy and reforms.