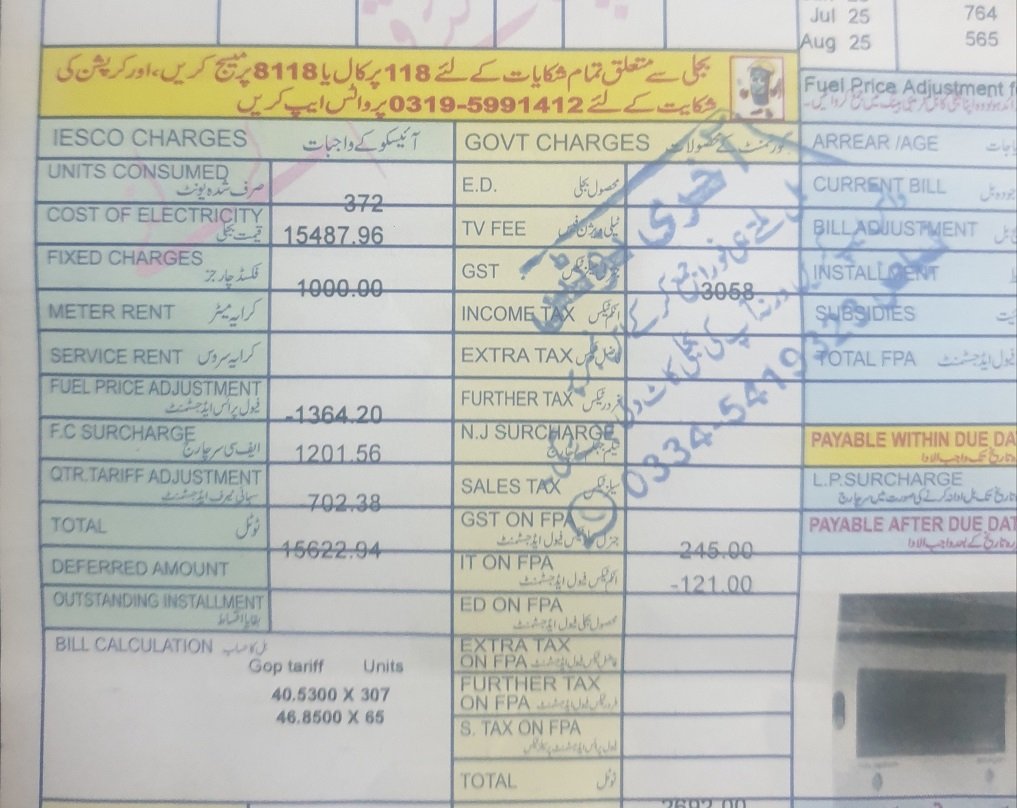

Every bill comes with a separate charges for electricity company & government charges settled in a final bill.

Electricity Bills are a major concern for everyone in Pakistan. There are several taxes all Pakistanis have to pay for their electricity usage. While there are discussions regarding peak hours as a factor in electricity prices. Electricity prices continue to increase every month in Pakistan.

Interestingly, the electricity consumers in Pakistan not only pay for the actual cost of power generation and distribution but also bear a range of government-imposed taxes, duties, and surcharges that significantly increase the final payable amount. These taxes serve multiple fiscal and policy objectives, such as revenue generation, regulation of consumption, and funding of development programs. Although, PM Shehbaz Announced Reduction in Electricity Prices by PKR 7.41 Per Unit in April 2025. Still, NEPRA continues to haunt the Pakistani consumers with inflated bills.

If we review the bills, there are multiple sub-sections within the each section. The bills are mainly divided under the two major categories. These are the electricity company and the government charges.

Electricity Company Charges

Speaking of Taxes Pakistanis Pay on Electricity Bills. The electricity companies in Pakistan charge their service fees under their tab. These include cost of electricity, fixed charges, meter rent and the service rent. Moreover, it includes Fuel Price Adjustments, F. C. Surcharge and the Tariff Adjustments for the Quarter. After clubbing all the charges in these sections, the bill calculation is made.

It is interesting to note that this all contributes to the electricity companies. The government charges are separately billed to the consumers.

Government Charges

Every electricity bill in Pakistan contains separate section of government charges. It includes E.D, TV Fee, General Sales Tax, Income Tax, Extra Tax, Further Tax, NJ Surcharge, GST on Fuel Price Adjustments, Income Tax on Fuel Price Adjustments and so on.

Types of Taxes on Electricity Bill in Pakistan

The following are the main types of taxes and charges typically levied on electricity bills in Pakistan:

1. General Sales Tax (GST)

- Nature: Indirect tax.

- Rate: Usually charged at 17% of the electricity bill amount (excluding other duties).

- Applicability: Collected from all categories of consumers (domestic, commercial, industrial) with some relief or exemptions available for lifeline consumers (low units usage).

- Purpose: Goes to the federal exchequer as part of general revenue.

2. Electricity Duty (ED)

- Nature: Provincial levy.

- Rate: Varies by province, usually ranging between 1.5% to 2% of the variable charges (unit consumption).

- Applicability: Charged on all types of consumers except specific exempt categories (such as agricultural tubewells in some provinces).

- Purpose: Collected by provincial governments to support local development.

3. Neelum–Jhelum Surcharge

- Nature: Project-specific surcharge.

- Rate: Typically Rs. 0.10 to Rs. 0.15 per unit.

- Applicability: Applied uniformly across all consumer categories.

- Purpose: Financing the Neelum–Jhelum Hydropower Project.

4. Financing Cost Surcharge (FCS)

- Nature: Federal levy.

- Rate: Around 0.43 paisa per unit (may vary).

- Purpose: Used to cover financial costs incurred by power sector loans and debt servicing.

5. Fuel Price Adjustment (FPA)

- Nature: Regulatory adjustment (not technically a tax, but functions as an extra charge).

- Applicability: Varies monthly, depending on international oil and gas prices.

- Purpose: Passed on to consumers to account for variations in fuel costs used in electricity generation.

6. Income Tax Withholding

- Nature: Withholding tax under the Income Tax Ordinance.

- Rate: A fixed percentage is charged, usually on commercial and industrial consumers. For domestic consumers, it is applicable if monthly consumption exceeds a defined threshold (e.g., Rs. 25,000 bill).

- Purpose: Advance income tax collection from non-filers and high-consumption consumers.

7. Television License Fee

- Nature: Ancillary federal fee.

- Rate: Rs. 35 per month for domestic consumers, higher for commercial/industrial connections.

- Purpose: Collected on behalf of Pakistan Television Corporation (PTV) to fund state-run broadcasting.

8. Miscellaneous Surcharges

- Tariff Rationalization Surcharge: Adjusts tariff differences among regions or consumer categories.

- Quarterly Tariff Adjustment (QTA): Adjusted every quarter based on power purchase prices.

- Debt Servicing Surcharge: Imposed to cover circular debt obligations in the power sector.

Interestingly, there are other similar taxes as well. The bills come up with newer forms of taxes every now and then. Moreover, the government had announced that Pakistan will Produce Cheap Electricity Using Thar Coal. However, the cheap electricity seems to be a forgotten vision. Hopefully, now you understand the Taxes Pakistanis Pay on Electricity Bills.